Did You Know a Life-Changing Event Could Reduce Your Medicare Premiums?

If you’re enrolled in Medicare and recently experienced a significant life-change, such as retiring or losing a spouse, you may be eligible to have your Medicare premiums reduced. Medicare premiums are based on a two-year lookback period. For example, your 2025 premiums are based on your 2023 tax return filed in 2024. But what if your income has significantly decreased since then?

Suppose your Medicare premiums have increased due to high income from a previous year. In that case, you may be able to reduce these costs if you’ve experienced a qualifying life-changing event that lowered your income.

Additionally, those that have recently retired and started Medicare immediately after retirement will usually need to report their work stoppage to avoid having their pre-retirement wages treated as part of their income when determining their Medicare premiums in the first year of retirement.

What is IRMAA?

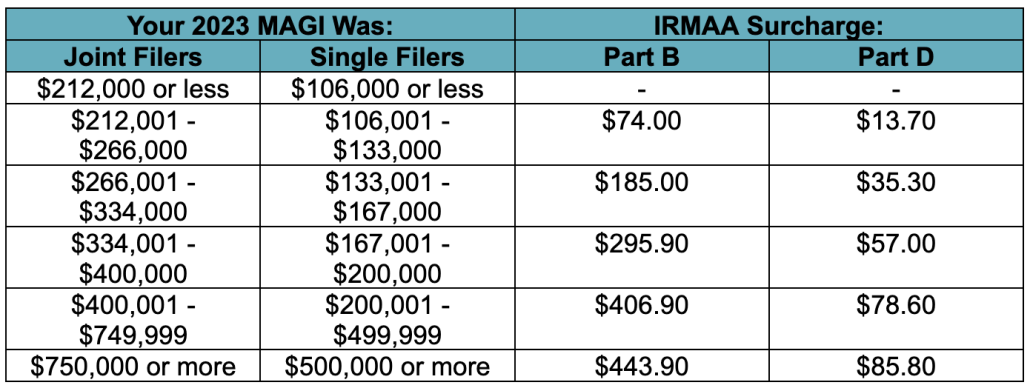

The Income-Related Monthly Adjustment Amount (IRMAA) is an extra charge added to your Medicare Part B and D premiums if your income from two years ago was above certain thresholds. Your IRMAA is based on your modified adjusted gross income (MAGI) which is your adjusted gross income plus tax-exempt interest income as reported on your individual income tax return. This is recalculated annually, so your IRMAA can vary from one year to the next.

Qualifying Life-Changing Events

Some of the more common life-changing events the Social Security Administration recognizes for an IRMAA reduction include:

- Work stoppage (such as retirement or job loss)

- Work reduction (moving to part-time or reduced hours)

- Death of a spouse

- Loss of pension income

- Divorce

How to Request a Review

If you’ve experienced one of these events and your income has decreased, you can file Form SSA-44 (Medicare Income-Related Monthly Adjustment Amount – Life Changing Event) with the Social Security Administration. You’ll need to provide documentation about the event and an estimate of your new, lower income. In the case of a married couple filing a joint return, both spouses should file separate forms. For example, if only one spouse worked and then retired, the life-changing event for the non-working spouse can be the working spouse’s retirement.

Other Considerations

During retirement, your sources of income can be more expansive than the paycheck you bring home during your working years and a rise in one of these could trigger an unexpected premium increase. The following sources of income should be taken into consideration when determining whether you qualify to request a reduction in your Medicare premiums:

IRA Distributions – Whether you are subject to required minimum distributions or making distributions for cash flow from a pre-tax IRA, these distributions will increase your taxable income.

Home Sales – If your capital gain from the sale of a home exceeds the exclusion amount ($500,000 for joint filers, $250,000 for single filers), it will be treated as taxable income. If you made a sizeable profit downsizing, it could increase your Medicare premiums two years later.

Municipal Bond Interest – Interest from municipal bonds may be tax-free for income tax purposes, but for IRMAA calculations, municipal interest income is added back to determine your modified adjusted gross income.

Roth Conversions – The amount you convert to a Roth IRA is considered taxable income in the year you make a conversion. While a Roth conversion can be an effective strategy to reduce taxes in retirement, proper planning is needed to effectively navigate the IRMAA brackets.

We Can Help

If you think you qualify, let us know as we are happy to assist you with the process. Lowering your Medicare premiums can potentially save you hundreds, or even thousands of dollars each year.

Sincerely,

Graves Light Lenhart Wealth